LifeSight’s enhanced post-retirement investment strategy: function determines form

in 2015 the Freedom and Choice legislation fundamentally changed the UK DC landscape. It meant that UK DC members no longer had to purchase an annuity with the bulk of their pensions savings at retirement. They could also choose to cash in their savings, remain invested post-retirement and draw down their savings as and when they choose. Or any combination of these three options.

This opened up a whole new world of post-retirement DC pensions provision. The purpose-built post-retirement investment options within LifeSight reflect the different objectives members typically have for how to use their savings, and balance some of the emerging complexity the industry is still trying to grapple with.

The key investment challenges of Freedom and Choice

Flexibility

The potential benefits of the increased flexibility the legislation introduced and the choice for members are plain to see.

However, as with most things, flexibility and choice is a double-edged sword. Without the right information, education and tools, members could easily make poor decisions such as:

- spending their savings too early, impacting their standard of living in late retirement;

- being too cautious and hoarding too much of their savings for too long, impacting their standard of living in early retirement;

- not buying an annuity even when this may be the best option.

Exhaustion risk

The previous default of buying a whole of life annuity, regardless of one’s assessment of value, had the clear benefit of continuing to pay out throughout the whole of a member’s life – and in some cases beyond.

One of the key risks for members who choose not to annuitise in a world of freedom and choice is that they outlive their savings and are left in a difficult financial situation. Sure, they may have a state pension to live on, but will that be sufficient? The risk of outliving and exhausting your pension is often exacerbated by the risk of cognitive decline in late retirement, whereby a member may not be well equipped to make complex decisions about managing money in their later years.

At LifeSight we are realistic about these challenges, and that’s reflected in the design of our post-retirement investment solutions and member communications strategy:

- Firstly the careful design of our investment strategies ensures that there is an appropriate balance between investment risk and return throughout members’ journeys, in particular such that we don’t fall into the trap of de-risking too much too early;

- Secondly our member communications and the tools we provide help members understand the impact of key investment and non-investment decisions, helping them consider what they want to do with their money and when.

Objective-based solutions

Last year the FCA released its regulation and guidance regarding ‘investment pathways’. These are essentially objective-based investment solutions, with four specific post-retirement objectives pre-defined by the FCA.

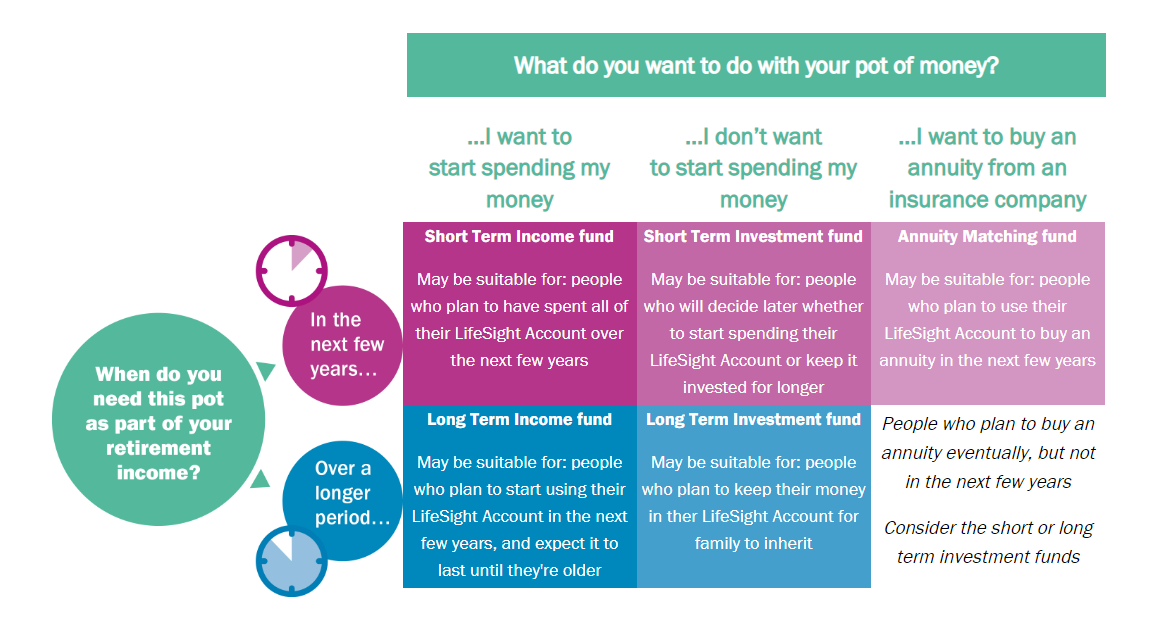

At LifeSight, we agree with this kind of objectives-led approach in principle. However, the details are also important, and we have developed our own set of post-retirement investment solutions around more flexible potential member objectives. Our approach asks members two key questions as shown below:

Critically, the investment strategies need to reflect the specifics of each option. For example, when and at what pace they are looking to withdraw and spend their savings. Understanding the time horizon for investment and the extent to which the funds being invested will be cash flow negative is critical in designing the appropriate investment mix. These features in turn determine whether the risk control should focus more on, say, short-term volatility or long-term cumulative downside. And these considerations then enable investment strategies to be designed with an appropriate balance between relevant measures of investment risk and return over time.

The ‘to and through’ retirement journey

Post-retirement investment solutions should not be developed in a vacuum; it is important to consider the member journey to and through retirement.

At LifeSight, our pre and post retirement investment solutions have been developed with this in mind. In particular, our members should generally see their level of investment risk reducing (or at least not increasing) as they graduate through the various stages of their pre and post-retirement journey – unless of course they deliberately change course themselves.

Complexity

It really is a complex area that is difficult for schemes and members to navigate.

From a member perspective, an effective DC solution should provide the right information, support and tools (an image from LifeSight’s support tool is below), alongside effective investment solutions, throughout the saving and spending journey.

From a scheme perspective, the challenge of providing freedom and choice at and post retirement is a key reason why many schemes have adopted or are considering moving to a master trust – either for the post-retirement piece, or the entire pensions solution.

LifeSight’s outlook

We’ll continue to monitor what members think about the purpose built post-retirement options and how they use them over time, and keep an eye on wider industry changes as the UK DC market continues to evolve in the coming years.

C. Marc Bautista

Lead Investment Adviser, LifeSight